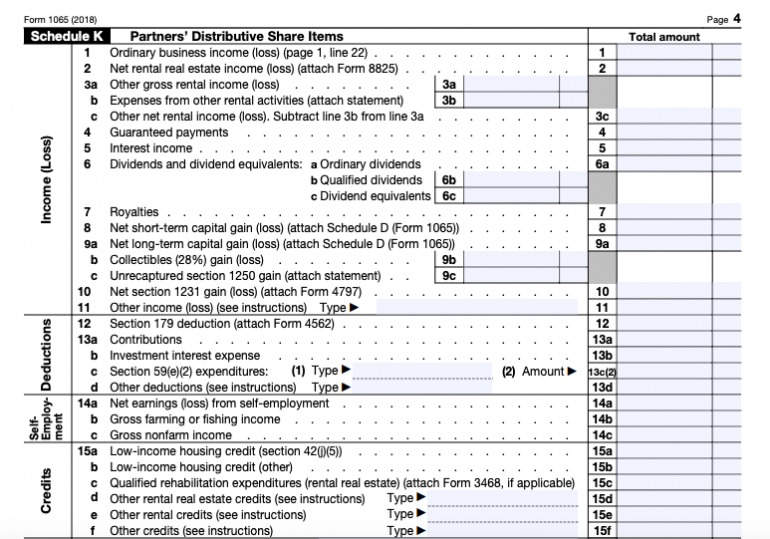

I just remembered that after I had to pay for the DE Franchise Tax. The IRS EIN letter had the 1065 form filing notice, but since there wasnt much activity going on with the company and I was pausing work, I forgot to file Form 1065, which is basically reporting profits and losses. To be safe, always prepare and file a tax return for any year that the business is in existence, whether or not there was any profit. Non-Resident here, I formed my DE Multi-member LLC in late 2019. So in the scenario above, a three-member LLC would be fined $267 ($89 x 3) for each month that the return is late, up to a maximum of 12 months. Returns with no tax are still subject to a late filing penalty of $89 per owner for each month (or part of a month) that a return is filed late. Otherwise, the business could be subject to the late filing penalties, which can add up fast. (Form 1120 is for regular corporations Form 1120S is for S Corporations.)īottom line: even a business with no profit should prepare and file a return. If that’s the case, then the LLC should file Form 1120 or Form 1120S by March 15, 2011, or file an extension on Form 7004, giving the LLC until Septemto file the 1120 or 1120S. If the LLC files the extension, then the LLC has until Sto file Form 1065.Īn LLC can also be taxed as a corporation (either a regular corporation or an S Corporation), provided the proper paperwork is filed with the IRS.

Since there are three owners (members), by default the LLC would be taxed as a partnership (assuming that you’ve haven’t chosen to be taxed as a corporation), so the business should file Form 1065 by April 15, 2011, or file an extension on Form 7004. Who Cannot be Included in a Composite Return Filing Partners who are corporations are required to file Form CIFT-620 to report any partnership income.

Since you have an IRS-issued federal tax ID, you are in their system and the IRS will be expecting you to file an income tax return for 2010.

0 kommentar(er)

0 kommentar(er)